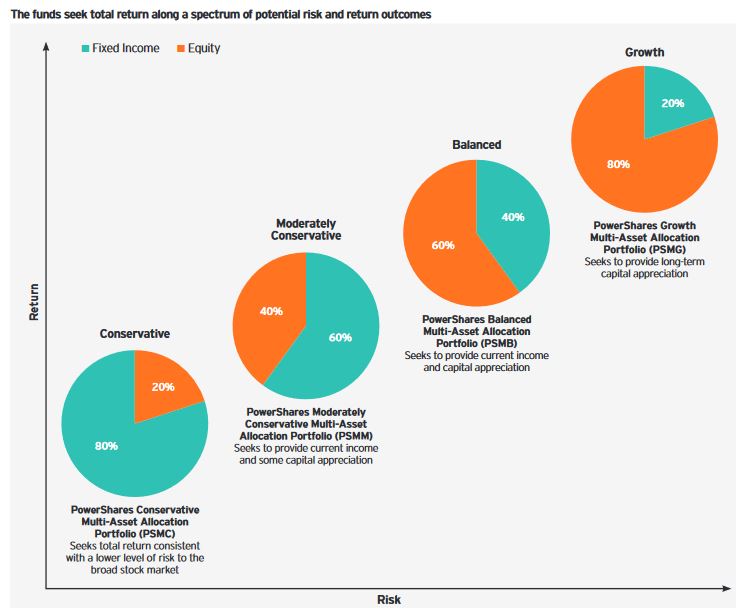

Invesco, begun trading Four Multi-Asset Allocation ETFs with targeted, pre-defined levels of risk exposure, on Thursday, February 23, 2017. Here is a synopsis of the new ETFs:

1.

FUND INFORMATION:

| Symbol: PSMM | Exchange: BATS |

| Name: PowerShares Moderately Conservative Multi-Asset Allocation Portfolio | Net Expense Ratio: 0.38% |

FUND OBJECTIVE:

The PowerShares Moderately Conservative Multi-Asset Allocation Portfolio is an actively managed ETF which seeks to provide current income and some capital appreciation. The Fund is a “fund of funds,” meaning that it invests its assets primarily in other underlying ETFs, rather than in securities of individual companies.

The Fund seeks to achieve its investment objective by allocating its assets using a moderately conservative investment style that seeks to maximize the benefits of diversification, which focuses on investing a greater portion of Fund assets in Underlying ETFs that invest primarily in fixed-income securities (Fixed Income ETFs), but also provides some exposure to Underlying ETFs that invest primarily in equity securities (Equity ETFs). Specifically, the Fund’s target allocation is to invest approximately 20%-50% of its total assets in Equity ETFs and approximately 50%-80% of its total assets in Fixed Income ETFs. Approximately 5%-15% of the Fund’s assets will be allocated to Underlying ETFs that invest primarily in foreign equity and foreign fixed income securities, as well as American depositary receipts (ADRs) and global depositary receipts (GDRs) that are based on those securities.

Fund Top Holdings (03/10/17):

| LDRI | PowerShares LadderRite 0-5 Year Corporate Bond Portfolio | 14.94% |

| PFIG | PowerShares Fundamental Investment Grade Corporate Bond Port | 12.90% |

| PRF | Powershares FTSE RAFI US 1000 Portfolio | 10.32% |

| PXLG | PowerShares Russell Top 200 Pure Growth Portfolio | 7.24% |

| SPLV | PowerShares S&P 500 Low Volatility Portfolio | 6.99% |

| PLW | PowerShares 1-30 Laddered Treasury Portfolio | 6.87% |

| PXF | PowerShares FTSE RAFI Developed Markets ex-U.S. Portfolio | 6.24% |

| PHB | PowerShares Fundamental High Yield Corporate Bond Portfolio | 5.91% |

| BKLN | PowerShares Senior Loan Portfolio | 4.99% |

| VTIP | Vanguard Short-Term Inflation-Protected Securities ETF | 4.99% |

Useful Links:

PSMM Home Page

2.

FUND INFORMATION:

| Symbol: PSMC | Exchange: BATS |

| Name: PowerShares Conservative Multi-Asset Allocation Portfolio | Net Expense Ratio: 0.37% |

FUND OBJECTIVE:

The PowerShares Conservative Multi-Asset Allocation Portfolio is an actively managed ETF which seeks total return consistent with a lower level of risk relative to the broad stock market. The Fund is a “fund of funds,” meaning that it invests its assets primarily in other underlying ETFs, rather than in securities of individual companies.

The Fund seeks to achieve its investment objective by allocating its assets using a conservative investment style that seeks to maximize the benefits of diversification, which focuses on investing a greater portion of Fund assets in Underlying ETFs that invest primarily in fixed-income securities (Fixed Income ETFs), but also provides some exposure to Underlying ETFs that invest primarily in equity securities (Equity ETFs),. Specifically, the Fund’s target allocation is to invest approximately 20%-50% of its total assets in Equity ETFs and approximately 50%-80% of its total assets in Fixed Income ETFs. Approximately 5%-10% of the Fund’s assets will be allocated to Underlying ETFs that invest primarily in foreign equity and foreign fixed income securities, as well as American depositary receipts (ADRs) and global depositary receipts (GDRs) that are based on those securities.

Fund Top Holdings (03/10/17):

| LDRI | PowerShares LadderRite 0-5 Year Corporate Bond Portfolio | 21.97% |

| PFIG | PowerShares Fundamental Investment Grade Corporate Bond Port | 14.92% |

| VTIP | Vanguard Short-Term Inflation-Protected Securities ETF | 9.99% |

| BKLN | PowerShares Senior Loan Portfolio | 8.00% |

| PHB | PowerShares Fundamental High Yield Corporate Bond Portfolio | 7.89% |

| PRF | Powershares FTSE RAFI US 1000 Portfolio | 7.10% |

| PGX | PowerShares Preferred Portfolio | 5.93% |

| PCY | PowerShares Emerging Markets Sovereign Debt Portfolio | 5.93% |

| PLW | PowerShares 1-30 Laddered Treasury Portfolio | 4.92% |

| PXLG | PowerShares Russell Top 200 Pure Growth Portfolio | 4.87% |

Useful Links:

PSMC Home Page

3.

FUND INFORMATION:

| Symbol: PSMB | Exchange: BATS |

| Name: PowerShares Balanced Multi-Asset Allocation Portfolio | Net Expense Ratio: 0.39% |

FUND OBJECTIVE:

The PowerShares Balanced Multi-Asset Allocation Portfolio is an actively managed ETF which seeks seeks to provide current income and capital appreciation. The Fund is a “fund of funds,” meaning that it invests its assets primarily in other underlying ETFs, rather than in securities of individual companies.

The Fund seeks to achieve its investment objective by allocating its assets using a balanced investment style that seeks to maximize the benefits of diversification, which focuses on investing portion of Fund assets both in Underlying ETFs that invest in fixed-income securities (Fixed Income ETFs) as well as in Underlying ETFs that invest primarily in equity securities (Equity ETFs). Specifically, the Fund’s target allocation is to invest approximately 50%-70% of its total assets in Equity ETFs and approximately 30%-50% of its total assets in Fixed Income ETFs. Approximately 10%-25% of the Fund’s assets will be allocated to Underlying ETFs that invest primarily in foreign equity and foreign fixed income securities, as well as American depositary receipts (ADRs) and global depositary receipts (GDRs) that are based on those securities. Some of those Underlying ETFs’ investments are in emerging markets.

Fund Top Holdings (03/10/17):

| PRF | Powershares FTSE RAFI US 1000 Portfolio | 14.62% |

| LDRI | PowerShares LadderRite 0-5 Year Corporate Bond Portfolio | 13.90% |

| PXLG | PowerShares Russell Top 200 Pure Growth Portfolio | 10.21% |

| SPLV | PowerShares S&P 500 Low Volatility Portfolio | 9.84% |

| PXF | PowerShares FTSE RAFI Developed Markets ex-U.S. Portfolio | 8.02% |

| PFIG | PowerShares Fundamental Investment Grade Corporate Bond Port | 6.92% |

| PLW | PowerShares 1-30 Laddered Treasury Portfolio | 6.85% |

| IDLV | PowerShares S&P International Developed Low Volatility Portf | 5.01% |

| PHB | PowerShares Fundamental High Yield Corporate Bond Portfolio | 4.91% |

| XMLV | PowerShares S&P MidCap Low Volatility Portfolio | 4.50% |

Useful Links:

PSMB Home Page

4.

FUND INFORMATION:

| Symbol: PSMG | Exchange: BATS |

| Name: PowerShares Growth Multi-Asset Allocation Portfolio | Net Expense Ratio: 0.39% |

FUND OBJECTIVE:

The PowerShares Growth Multi-Asset Allocation Portfolio is an actively managed ETF which seeks seeks to provide long-term capital appreciation.

The Fund is a “fund of funds,” meaning that it invests its assets primarily in other underlying ETFs, rather than in securities of individual companies. The Fund seeks to achieve its investment objective by allocating its assets using a growth investment style that seeks to maximize the benefits of diversification, which focuses on investing a greater portion of Fund assets in Underlying ETFs that invest primarily in equity securities (Equity ETFs), but also provides some exposure to Underlying ETFs that invest primarily in fixed-income (“Fixed Income ETFs”). Specifically, the Fund’s target allocation is to invest approximately 60%-80% of its total assets in Equity ETFs and approximately 20%-40% of its total assets in Fixed Income ETFs. Approximately 20%-30% of the Fund’s assets will be allocated to Underlying ETFs that invest primarily in foreign equity and foreign fixed income securities, as well as American depositary receipts (ADRs) and global depositary receipts (“GDRs”) that are based on those securities. Some of those Underlying ETFs’ investments are in emerging markets.

Fund Top Holdings (03/10/17):

| PRF | Powershares FTSE RAFI US 1000 Portfolio | 18.52% |

| PXLG | PowerShares Russell Top 200 Pure Growth Portfolio | 12.77% |

| SPLV | PowerShares S&P 500 Low Volatility Portfolio | 12.25% |

| PXF | PowerShares FTSE RAFI Developed Markets ex-U.S. Portfolio | 11.47% |

| LDRI | PowerShares LadderRite 0-5 Year Corporate Bond Portfolio | 8.23% |

| IDLV | PowerShares S&P International Developed Low Volatility Portf | 7.02% |

| PRFZ | PowerShares FTSE RAFI US 1500 Small-Mid Portfolio | 6.29% |

| PFIG | PowerShares Fundamental Investment Grade Corporate Bond Port | 5.24% |

| PLW | PowerShares 1-30 Laddered Treasury Portfolio | 3.96% |

| PXH | PowerShares FTSE RAFI Emerging Markets Portfolio | 3.36% |

Useful Links:

PSMG Home Page

INVESTMENT PROCESS:

The Funds’ sub-adviser uses the following investment process to construct the Funds’ portfolio:

(1) a strategic allocation across broad asset classes (i.e., equities and fixed income securities) and particular investment factors within those classes (e.g., for fixed income securities, exposure to domestic, international, corporate, government, high-yield and investment grade bonds; for equity securities, exposure to domestic and international stocks);

(2) selection of Underlying ETFs that best represent those broad asset classes and factor exposures, based on a comprehensive quantitative and qualitative criteria (such as management experience and structure, investment process, performance and risk metrics);

(3) determination by the Fund’s sub-adviser of target weightings in each Underlying ETF in a manner that seeks to manage the amount of active risk contributed by each Underlying ETF; and

(4) ongoing monitoring of the Fund’s performance and risk. The Fund typically holds a limited number of securities (generally 10-20).

Based on the portfolio managers’ research, the strategic allocations of the portfolio are diversified to gain exposure to areas of the market that the portfolio managers believe may perform well over a full market cycle, while still creating a moderately conservative portfolio with a somewhat lower risk profile than the overall stock market. At any given time, the Fund’s asset class allocations may not match the above percentage weightings due to market fluctuations, cash flows and other factors. The Fund’s sub-adviser may add or eliminate certain Underlying ETFs from the Fund’s portfolio and the Fund’s sub-adviser may also change the target percentage of the Fund’s assets allocated to a given asset class or Underlying ETF, all without shareholder approval. A list of the Underlying ETFs and their target weightings is located in the Fund’s prospectus.

Category: Multi Asset> Multi Asset Strategy> Asset Allocation

ETFtrack comment:

Here is a comment from Jason Bloom, Global Market Strategist at PowerShares by Invesco:

“Given the increasingly complex markets and varying risk profiles of our clients, we’re excited to bring Invesco’s broad range of capabilities together in simplified, single ticket solutions.”

Each of the actively managed portfolios includes exposure to smart beta ETFs, a rules-based investment methodology that uses factor selection and/or alternative weighting approach in an effort to outperform a benchmark, reduce portfolio risk, or both. Combining smart beta’s rules-based exposure with the features of active management, provides investors with portfolio strategies that go beyond the limitations of traditional passive investing and benchmark-centric active management.