Weekend 12/08 & 12/09

U.S. says March 1 ‘hard deadline’ for trade deal with China – Reuters

One JPMorgan Strategist Finds The Buyback Party Is Over, Hopes Not To Be Lumped In With The “Fake News” – Zerohedge

Yellow vest protests ‘economic catastrophe’ for France – bbc

China Factory, Consumer Inflation Slows Amid Weakening Demand – Bloomberg

“The Capitulation Begins”: Everyone Is Bearish But No-One Is Short – Zerohedge

Germany Willing to Merge Deutsche Bank, Commerzbank, Focus Says – Bloomberg

Friday 12/07

OPEC, Russia agree to slash oil output despite Trump pressure – Reuters

Taiwan: Trade disappoints as Apple pulls order – ing

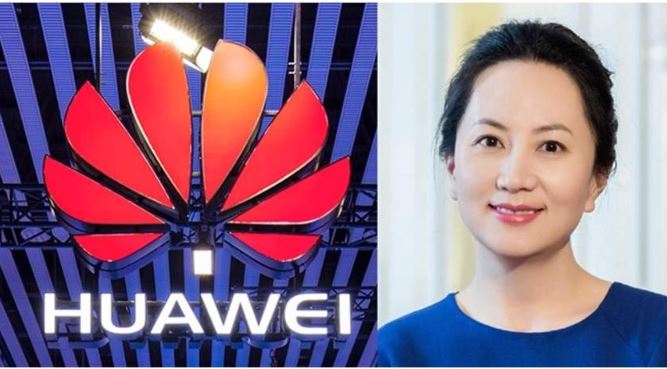

Huawei arrest stokes fears of China reprisals among America Inc executives – Reuters

China Prepares Retaliation To Huawei CFO Arrest – Zerohedge

Nomura explains why the US yield curve’s inversion is not what investors should fret about – businessinsider

Japan may move to restrict Huawei, ZTE from government use – Marketwatch

China Debates Pros and Cons of Retaliation After Huawei Arrest – Bloomberg

US strikes at heart of ‘Made in China’ with Huawei arrest – asianikkei

Markets predictions: 2019 to bring new level of uncertainty – ft

All Around the World, Central Bank Independence Is Under Threat – Bloomberg

Delinking of US and China economies to weigh on Asian equities in 2019, says UBS – scmp

RBA: Rate cuts are not off the table, and ‘QE is a policy option in Australia’ – businessinsider

Huawei arrest creates concerns in Silicon Valley as well as abroad – Marketwatch

Delinking of US and China economies to weigh on Asian equities in 2019, says UBS – scmp

US ‘was probing Huawei for an alleged global banking scheme to evade US sanctions on Iran before it arrested Sabrina Meng Wanzhou’ – scmp

Thursday 12/06

Getting Huawei CFO to U.S. After Canada Bust May Take Years – Βloomberg

Get ready for the ‘Scrooge market’ of 2019, investor says – yahoofinance

US crude sinks 2.7%, settling at $51.49, after OPEC delays decision on production cut levels – cnbc

Auto supplier Bosch sees car market stagnating in 2019 – Reuters

Dovish Fed Hike Seen by JPMorgan as Markets Flash ‘Slowdown’ – Βloomberg

U.S. factory orders post largest drop in more than a year – Reuters

Trump’s Trade Deficit Tumbles To Worst In A Decade As China Gap Hits Record High – Zerohedge

ADP Employment Disappoints: “Job Growth Has Likely Peaked” – Zerohedge

Explainer: What is an inverted yield curve? – Reuters

European auto sector hits lowest level since July 2016 – ft

China Says It’s Implementing Deals Done With U.S. on Trade – Bloomberg

Should we worry about Huawei? – BBC

US may use arrest of Huawei CFO Sabrina Meng to push China on trade – scmp

Canada arrested Huawei’s CFO, and the US is seeking to extradite her – businessinsider

Australia’s trade surplus comes up short – businessinsider

For the first time, China confirmed major details about the Trump-Xi trade deal. It could only intensify the scramble over the next 90 days – businessinsider

Wednesday 12/05

Trade war and growth worries drive markets down – business live – guardian

Trump Offers German Automakers a Pause on Car Tariffs, for Now – nyt

ECB policymakers debate new ways out of easy money – sources – Reuters

It’s the Worst Time in Decades to Make Money in Markets – Bloomberg

What President George H.W. Bush’s day of mourning means for stock, bond and commodity traders – Marketwatch

France’s Tax Burden Now the Highest of Any OECD Country – Bloomberg

Eurozone economic growth continues to slow in November – markit

German Business activity growth eases to six-month low in November- markit

Australia’s GDP weaker than expected in Q3 – Marketwatch

Caixin: China’s service sector grew faster in Nov. – Marketwatch

These Charts Show China’s Uphill Battle With Bond Defaults – Bloomberg

China is said to be resuming imports of US liquefied gas and soybeans amid trade war truce – scmp

Tuesday 12/04

UK car industry fears ‘huge’ disruption after no-deal Brexit – business live – guardian

Top 5 Things to Know in The Market on Tuesday – investing

The economist who discovered the yield curve’s predictive powers says he’s getting worried – cnbc

Here Is What Triggered Today’s Sudden Stock Liquidation – Zerohedge

As Bank Shares Burn, Here’s What CEOs Are Telling Investors – Bloomberg

DoubleLine’s Gundlach: Treasury curve inversion signal ‘economy poised to weaken’ – Reuters

Gundlach: Yield Curve Inversion Shows “Total Market Disbelief” In The Fed’s Hiking Plans – Zerohedge

White House keeps contradicting itself on U.S.-China trade negotiations – yahoofinance

Cable Slides To 18-Month Low After May Loses Historic Contempt Vote – Zerohedge

Toll Brothers Shocks With 13% Plunge In Orders As California Falls A Staggering 39% – Zerohedge

Stocks Sink As Trump Confirms Trade War Not Over: “I’m A Tariff Man” – Zerohedge

The U.S. and China’s Trade Truce Statements, Compared – Bloomberg

These Outrageous Europe Events Would Shake Markets – Zerohedge

China Auto Tariff Mystery Over: Kudlow Denies Trump Tweet – Zerohedge

Apple downgraded by HSBC, which said – cnbc

“Our Clients Are Shifting From “End-Of-Cycle” To Outright “Recession” Trades” – Zerohedge

French government to delay fuel tax hike after violent protests – cnbc

OPEC works on deal to cut output, still needs Russia on board – Reuters

White House hails China trade truce as skeptics raise doubts – ap

The bond market just flashed a major ‘red flag’ — and it could be signaling a US recession – businessinsider

Monday 12/03

Markets surge after US-China trade truce – business live – guardian

JP Morgan’s market-moving strategist says rally has further to go: ‘Pain trade is on the upside’ – cnbc

A New U.S. Yield Curve Is Racing Toward Inversion – Bloomberg

The tax cut isn’t trickling down to workers – Marketwatch

BlackRock’s Emerging-Markets ETF Had a Record Month – Bloomberg

Congress nears short-term deal to avoid government shutdown – politico

U.S. expects immediate action from China on trade commitments – Reuters

Rally Time or Time Out? Wall Street Asks What’s Next for Stocks – Bloomberg

US Manufacturing Economy Rebounds As Prices Paid Plummet – Zerohedge

Here Are China’s Biggest Stock Winners From U.S. Trade Thaw – Bloomberg

Chipmakers are rallying after Trump and Xi came to a tentative truce on trade war – businessinsider

Xi deftly practices the diplomacy of buying time – Reuters

Morgan Stanley Upgrades ’19 China Stocks Call on Trade Ceasefire – Bloomberg

Forced tech transfers and intellectual property theft will likely dominate trade talks after Trump-Xi deal – cnbc

Mnuchin says Trump ‘liked’ Fed chief Powell’s speech that boosted markets last week – cnbc

US, China ties to remain contentious, to affect Asia: Moody’s – koreaherald

The next date to watch in the US-China trade war is Dec. 18, expert says – cnbc

U.S. Farmers Have Little to Cheer From China Trade Truce, So Far – Bloomberg

Contrasting Chinese, U.S. statements on trade war agreement – Reuters

Markit Eurozone Manufacturing PMI – Weakest growth of manufacturing economy since August 2016 – markit

GERMAN Manufacturing PMI slips to 31-month low as downturn in new orders deepens – markit

Italian manufacturing conditions deteriorate at quickest pace for nearly four years- markit

Qatar pulls out of Opec as relations with neighbours sour – FT

It’s An Extremely Busy Week Ahead: Here Are The Highlights – Zerohedge

Qatar to Leave OPEC as Politics Finally Rupture Oil Cartel – Bloomberg

Trump tweets China to cut tax on US-made cars, revs up auto stocks – cnbc

Caixin: China’s factory activity picked up in Nov.- Marketwatch