ALPS, begun trading a new US Sector Momentum ETF, the ALPS Dorsey Wright Sector Momentum ETF (Nasdaq: SWIN), on Thuesday, January 10, 2017. Here is a synopsis of the new ETF:

FUND INFORMATION:

| Symbol: SWIN | Exchange: NASDAQ |

| Name: ALPS Dorsey Wright Sector Momentum ETF | Net Expense Ratio: 0.40% |

FUND OBJECTIVE:

The ALPS Dorsey Wright Sector Momentum ETF seeks investment results that correspond (before fees and expenses) generally to the performance of the Dorsey Wright US Sector Momentum Index.

REFERENCE INDEX:

The Dorsey Wright US Sector Momentum Index is a rules‑based index intended to track the overall performance of the stocks with the highest relative strength or “momentum” within the NASDAQ US Large Mid Cap Index (the “NASDAQ Index”) on a sector‑by‑sector basis.

“Relative strength” is an investing strategy that seeks to determine the strongest performing securities by measuring certain factors, such as a security’s relative positive performance against the overall market or a security’s relative strength value, which is derived by comparing the rate of increase of the security’s price to that of a benchmark index. Nasdaq, Inc. (Index Provider) uses a proprietary methodology to analyze the relative strength of each security within the universe of eligible securities and determine a “momentum” score. In general, momentum is the tendency of a security to exhibit persistence in its relative strength; a “momentum” style of investing emphasizes investing in securities that have had better recent performance compared to other securities. The momentum score for each security included in the Underlying Index is based on intermediate and long‑term upward price movements of the security as compared to a representative benchmark and other eligible securities within the universe.

The Underlying Index is reconstituted quarterly and generally consists of 50 stocks on each reconstitution date. The Underlying Index’s stocks must be constituents of the NASDAQ Index. The Underlying Index methodology uses a proprietary Relative Strength Matrix to rank 10 sectors of the market: Basic Materials, Consumer Cyclicals, Consumer Staples, Energy, Financials, Healthcare, Industrials, Technology, Telecommunications, and Utilities (the “Sectors”) according to their relative strength as of 5 business days prior to each quarterly reconstitution date. The Underlying Index methodology then categorizes the NASDAQ Index’s constituents into groups that correspond to their Sector classifications (the “Sector Groups”). NASDAQ Index’s constituents that the Index Provider would generally categorize as identified with the Real Estate sector are incorporated into the Financials Sector Group. The Underlying Index methodology then ranks the stocks within each Sector Group based on momentum with eligible stocks being selected from the seven Sector Groups with the highest relative strength ratings. In order to be considered for inclusion in the Underlying Index, each stock from the eligible universe must meet a minimum relative strength score as determined by the Index Provider. The top 10 stocks from each of the 3 highest relative strength Sector Groups, and the top 5 stocks in each of the next 4 highest relative strength Sector Groups are selected for inclusion in the Underlying Index. In the event that a Sector Group does not contain the required number of stocks that meet the minimum relative strength score requirement, the Underlying Index will make additional investments in the stock with the highest relative strength score regardless of its Sector Group classification. The eligible stocks that are selected for inclusion in the Underlying Index’s portfolio are equally weighted.

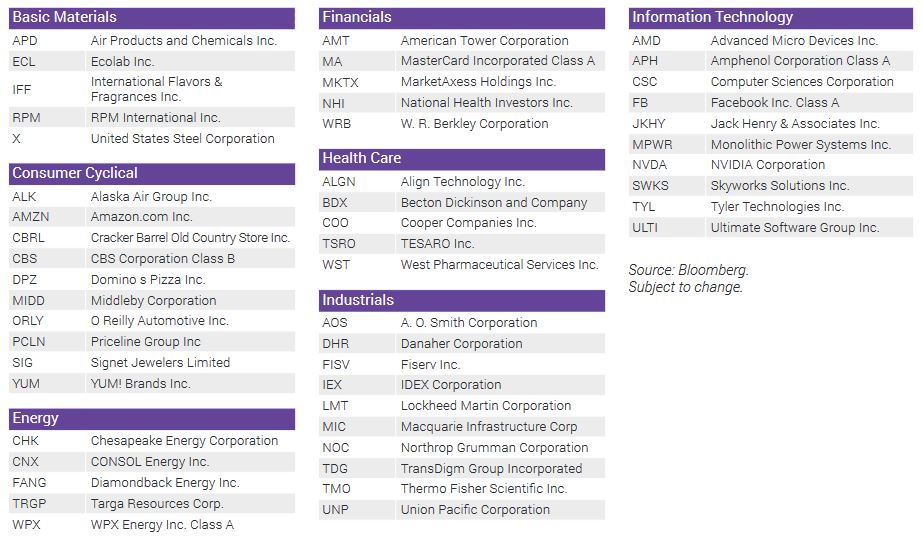

Index Holdings (01/06/17):

Index Sector Weightings (01/06/17):

| Info Tech | 20.22% |

| Industrials | 20.01% |

| Consumer Cyclical | 19.94% |

| Healthcare | 10.00% |

| Financials | 9.97% |

| Energy | 9.95% |

| Basic Materials | 9.91% |

Useful Links:

SWIN Home Page

ETFtrack comment:

Here is a comment from Mike Akins, SVP & Head of ETFs for ALPS:

“SWIN is the first Momentum ETF to combine both macro (sector) and micro (stock) level screens. We believe its unique two-screen construct creates opportunity for outperformance in strong sector momentum cycles, while simultaneously maintaining a diversification cushion to help weather periods where no clear sector leadership is present.”