Pacer ETFs, begun trading 3 new ETFs: the Pacer Trendpilot 750 ETF (BATS: PTLC), the Pacer Trendpilot 450 ETF (BATS: PTMC) and the Pacer Trendpilot 100 ETF (BATS: PTNQ) on Friday, June 12, 2015.

Here is a synopsis of the new ETFs:

1.

FUND INFORMATION:

| Symbol: PTLC | Exchange: BATS |

| Name: Pacer Trendpilot 750 ETF | Net Expense Ratio: 0.60% |

FUND OBJECTIVE:

The Pacer Trendpilot 750 ETF seeks to track the total return performance, before fees and expenses, of the Pacer Wilshire US Large-Cap Trendpilot Index.

REFERENCE INDEX:

The Pacer Wilshire US Large-Cap Trendpilot Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure on 3 indicators:

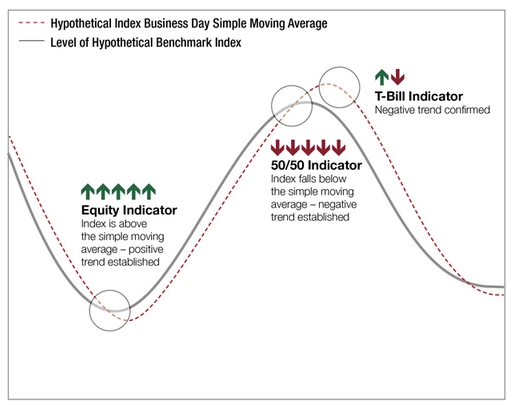

a. Equity Indicator: When the Wilshire US Large-Cap Total Return Index closes above its 200-business day simple moving average for five consecutive business days, the exposure of the Index will be 100% to the Wilshire US Large-Cap Index

b. 50/50 Indicator: When the Wilshire US Large-Cap Total Return Index closes below its 200-business day simple moving average for five consecutive business days, the exposure of the Index will be 50% to the Wilshire US Large-Cap Index and 50% to 3-Month US Treasury bills.

c. T-Bill Indicator: When the Wilshire US Large-Cap Total Return’s 200-business day simple moving average closes lower than its value from five business days earlier, the exposure of the Index will be 100% to 3-Month US Treasury bills. Once the T-Bill Indicator has been triggered, the Index will not return to its 50/50 position unless the Equity Indicator is first triggered, followed by the 50/50 Indicator being triggered.

The Wilshire Large-Cap TR is a total return version of the Wilshire Large-Cap and reflects the reinvestment of dividends paid by the securities in the Wilshire Large-Cap. The Wilshire US Large-Cap is a rules-based, float-adjusted, market capitalization-weighted index comprised of approximately 750 of the largest companies in the Wilshire 5000 Total Market Index (the “Wilshire 5000”). The Wilshire 5000 is an unmanaged, market capitalization-weighted index that measures the performance of all equity securities of U.S. headquartered issuers with readily available price data.

Useful Links:

PTLC Home Page

2.

FUND INFORMATION:

| Symbol: PTMC | Exchange: BATS |

| Name: Pacer Trendpilot 450 ETF | Net Expense Ratio: 0.60% |

FUND OBJECTIVE:

The Pacer Trendpilot 450 ETF seeks to track the total return performance, before fees and expenses, of the Pacer Wilshire US Mid-Cap Trendpilot Index.

REFERENCE INDEX:

The Pacer Wilshire US Mid-Cap Trendpilot Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure on 3 indicators:

a. Equity Indicator: When the Wilshire US Mid-Cap Total Return Index closes above its 200-business day simple moving average for five consecutive business days, the exposure of the Index will be 100% to the Wilshire US Mid-Cap Index.

b. 50/50 Indicator: When the Wilshire US Mid-Cap Total Return Index closes below its 200-business day simple moving average for five consecutive business days, the exposure of the Index will be 50% to the Wilshire US Mid-Cap Index and 50% to 3-Month US Treasury bills.

c. T-Bill Indicator: When the Wilshire US Mid-Cap Total Return’s 200-business day simple moving average closes lower than its value from five business days earlier, the exposure of the Index will be 100% to 3-Month US Treasury bills. Once the T-Bill Indicator has been triggered, the Index will not return to its 50/50 position unless the Equity Indicator is first triggered, followed by the 50/50 Indicator being triggered.

The Wilshire Mid-Cap TR is a total return version of the Wilshire Mid-Cap and reflects the reinvestment of dividends paid by the securities in the Wilshire Mid-Cap. The Wilshire Mid-Cap is a rules-based, float-adjusted, market capitalization-weighted index comprised of approximately 500 mid-sized companies ranked between 500 and 1,000 in the Wilshire 5000 Total Market Index™ (the “Wilshire 5000”). The Wilshire 5000 is an unmanaged, market capitalization-weighted index that measures the performance of all equity securities of U.S. headquartered issuers with readily available price data.

Useful Links:

PTMC Home Page

3.

FUND INFORMATION:

| Symbol: PTNQ | Exchange: BATS |

| Name: Pacer Trendpilot 100 ETF | Net Expense Ratio: 0.65% |

FUND OBJECTIVE:

The Pacer Trendpilot 100 ETF seeks to track the total return performance, before fees and expenses, of the Pacer NASDAQ-100 Trendpilot Index.

REFERENCE INDEX:

The Pacer NASDAQ-100 Trendpilot Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure on 3 indicators:

a. Equity Indicator: When the NASDAQ-100 Total Return Index closes above its 200-business day simple moving average for five consecutive business days, the exposure of the Index will be 100% to the NASDAQ-100 Index.

b. 50/50 Indicator: When the NASDAQ-100 Total Return Index closes below its 200-business day simple moving average for five consecutive business days, the exposure of the Index will be 50% to the NASDAQ-100 Index and 50% to 3-Month US Treasury bills.

c. T-Bill Indicator: When the NASDAQ-100 Total Return’s 200-business day simple moving average closes lower than its value from five business days earlier, the exposure of the Index will be 100% to 3-Month US Treasury bills. Once the T-Bill Indicator has been triggered, the Index will not return to its 50/50 position unless the Equity Indicator is first triggered, followed by the 50/50 Indicator being triggered.

The NASDAQ-100 TR is a total return version of the NASDAQ-100 and reflects the reinvestment of dividends paid by the securities in the NASDAQ-100. The NASDAQ-100 Index includes approximately 100 of the largest non-financial securities listed on The NASDAQ Stock Market based on market capitalization. The NASDAQ-100 Index comprises securities of companies across major industry groups, including computer, biotechnology, healthcare, telecommunications and transportation. However, it does not contain securities of financial companies, including investment companies. The NASDAQ 100 Index was developed by NASDAQ OMX. There is no minimum market capitalization requirement for inclusion in the NASDAQ-100 Index. Inclusion is determined based on the top 100 largest issuers based on

market capitalization meeting all other eligibility requirements. As of May 21, 2015, the range of market capitalizations of companies in the NASDAQ-100 Index was approximately $6.2 billion to $756.9 billion.

Useful Links:

PTNQ Home Page

Trendpilot Strategy

* Participate in the market when it is trending up.

* Pare back market exposure during short-term market down trends.

* Prevent extended declines by moving to T-bills during long-term market down trends.