ProShares, begun trading two new ETFs that offers investors the chance to invest in the decline of retail and the rise of ecommerce, the ProShares Decline of the Retail Store ETF (NyseArca: EMTY) and the ProShares Long Online/Short Stores ETF (NyseArca: CLIX) on Thursday, November 16, 2017. Here is a synopsis of the new ETFs:

1.

FUND INFORMATION:

| Symbol: EMTY | Exchange: NYSE ARCA |

| Name: ProShares Decline of the Retail Store ETF | Net Expense Ratio: 0.65% |

FUND OBJECTIVE:

The ProShares Decline of the Retail Store ETF seeks capital appreciation from the decline of bricks and mortar retailers through short exposure (-1x) to the SolactiveProShares

Bricks and Mortar Retail Store Index.

The Fund seeks investment results for a single day only, not for longer periods. A “single day” is measured from the time the Fund calculates its net asset value (NAV) to the time of the Fund’s next NAV calculation. The return of the Fund for periods longer than a single day will be the result of each day’s returns compounded over the period, which will very likely differ from the inverse (-1x) of the return of the Fund’s underlying index for that period. For periods longer than a single day, the Fund will lose money when the level of its underlying index is flat, and it is possible that the Fund will lose money even if the level of its underlying index falls. Longer holding periods, higher index volatility, inverse exposure and greater leverage each exacerbate the impact of compounding on an investor’s returns. During periods of higher volatility, the volatility of the Fund’s underlying index may affect the Fund’s return as much as or more than the return of the index.

REFERENCE INDEX:

The SolactiveProShares Bricks and Mortar Retail Store Index seeks to measure the performance of publicly traded “bricks and mortar” retail companies whose retail revenue is derived principally from in-store sales. Companies must derive at least 75% of their retail revenues from in-store sales to be included in the Index. The Index includes only U.S. companies. The Index is rebalanced monthly to equal weight and reconstituted in June of each year. The Fund will invest principally in financial instruments as Derivatives, Swaps, Money Market Instruments, U.S. Treasury Bills and Repurchase Agreements.

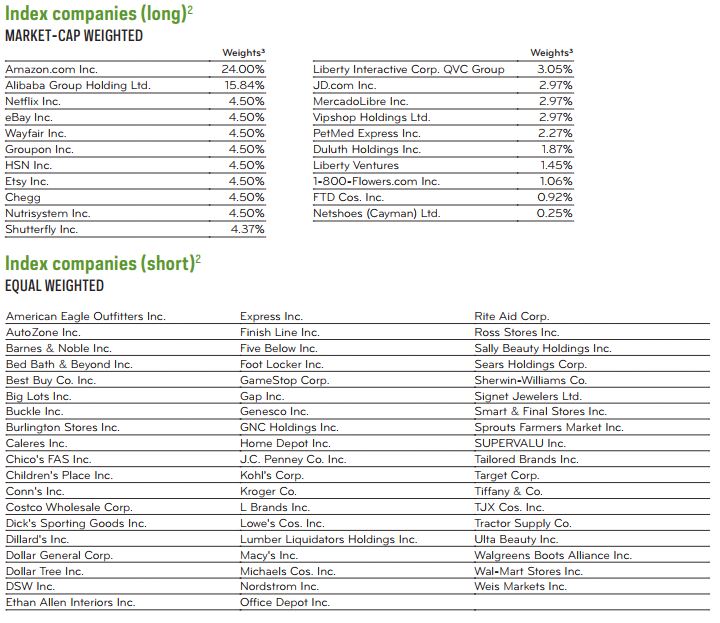

Index Companies – Equally Weighted (10/31/17):

Useful Links:

EMTY Home Page

2.

FUND INFORMATION:

| Symbol: CLIX | Exchange: NYSE ARCA |

| Name: ProShares Long Online/Short Stores ETF | Net Expense Ratio: 0.65% |

FUND OBJECTIVE:

The ProShares Long Online/Short Stores ETF seeks investment results, before fees and expenses, that track the performance of the ProShares Long Online/Short Stores Index.

REFERENCE INDEX:

The ProShares Long Online/Short Stores Index consists of long positions in the online retailers included in the ProShares Online Retail Index (Online Index) and short positions in the “bricks and mortar” retailers included in the Solactive-ProShares Bricks and Mortar Retail Store Index (Retail Store Index).

The Index are designed to help investors take advantage of both sides of retail’s transformation by combining full (100%) long exposure to online retailers with a partial (50%) short position to retailers that depend on physical stores.

A potential advantage of a long/short portfolio is that the long and short positions may offset one another, resulting in a lower net exposure to the direction of the market. For example, the 100% long/50% short structure may allow the Index to benefit in market environments where both online and store-based retailers are generally rising in value and may provide a buffer in environments where both online and store-based retailers are generally declining.

The Online Index seeks to measure the performance of publicly traded companies that principally sell online or through other non-store sales channels (Online Retailers). The Online Index includes U.S. and non-U.S. companies. To be included in the Online Index, an online retailer’s securities must be listed on a U.S. stock exchange and must meet certain liquidity and market capitalization requirements. Non-U.S. companies may not make up more than 25% of the Online Index. Companies are weighted in the Online Index using a modified market capitalization approach.

The Retail Store Index seeks to measure the performance of publicly traded “bricks and mortar” retail companies whose retail revenue is derived principally from in-store sales. The Retail Store Index includes only U.S. companies. Companies must derive at least 75% of their retail revenues from in-store sales to be included in the Retail Store Index. In addition a company’s securities must be listed on a U.S. stock exchange and must meet certain liquidity and market capitalization requirements. The Index is rebalanced monthly to equal weight and reconstituted in June of each year.

Under normal circumstances, the Fund will invest at least 80% of its total assets in the component securities of the Online Index. The Fund intends to obtain short exposure to the positions in the Retail Store Index by investing in derivatives.

Useful Links:

CLIX Home Page

ETFtrack comment:

Here is a comment from Michael L. Sapir, co‑founder and CEO of ProShare Advisors, LLC, the advisor to ProShares:

About EMTY:

“Investors are witnessing signs of trouble in the malls and falling stock prices in the markets. For the first time, investors can turn these trends into a potential investment opportunity through an ETF. Retail is being profoundly disrupted by shoppers moving online, oversaturated markets and changing consumer behaviors. While some retailers that rely on in-store sales may be able to adapt, we believe those will be a minority, and that the long-term trend is against these companies and in favor EMTY’s strategy.”

About CLIX:

“With CLIX, investors not only receive the investment potential of online retailers like Amazon and Alibaba but also have the possibility of additional return from short exposure to traditional retailers. CLIX’s 50% net exposure to the equity markets may result in less volatility than typical long-only equity strategies.”