ITML, ITMS Closed 09/29/2017

VanEck, begun trading two new Municipal Bond ETFs, the VanEck Vectors AMT-Free 12-17 Year Intermediate Municipal Index ETF (Bats: ITML) and the VanEck Vectors AMT-Free 6-8 Year Intermediate Municipal Index ETF (Bats: ITMS) on Tuesday, September 20, 2016. Here is a synopsis of the new ETFs:

1.

FUND INFORMATION:

| Symbol: ITML | Exchange: BATS |

| Name: VanEck Vectors AMT-Free 12-17 Year Intermediate Municipal Index ETF | Net Expense Ratio: 0.24% |

FUND OBJECTIVE:

The VanEck Vectors AMT-Free 12-17 Year Intermediate Municipal Index ETF seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Bloomberg Barclays AMT-Free 12-17 Year Intermediate Continuous Municipal Index.

The Fund is classified as a non-diversified fund and, therefore, may invest a greater percentage of its assets in a particular issuer. The Fund may concentrate its investments in a particular industry or group of industries to the extent that the Index concentrates in an industry or group of industries.

REFERENCE INDEX:

The Bloomberg Barclays AMT-Free 12-17 Year Intermediate Continuous Municipal Index is comprised of publicly traded municipal bonds that cover the U.S. dollar-denominated tax-exempt bond market with final maturities of 12-17 years.

As of June 30, 2016, the general obligations, transportation and special tax (i.e., revenue bonds backed by a specific tax) sectors each represented a significant portion of the Index.

As of June 30, 2016, approximately 17% of the Index consisted of municipal bonds issued by issuers located in California and approximately 16% of the Index consisted of municipal bonds issued by issuers located in New York.

Fund Top Holdings (09/21/16):

| Houston Independent School District | 6.24% |

| Philadelphia Gas Works Co | 6.11% |

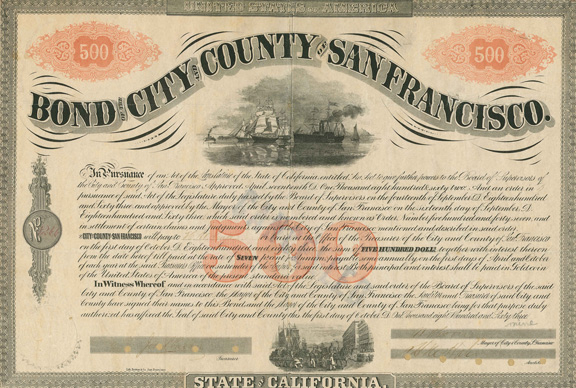

| State Of California | 5.74% |

| State Of Hawaii | 5.54% |

| Charleston Educational Excellence Finan | 5.47% |

| California Health Facilities Financing | 5.36% |

| State Of Washington | 4.88% |

| Utility Debt Securitization Authority | 4.36% |

| Dallas/Fort Worth International Airport | 3.46% |

| New York State Urban Development Corp | 2.50% |

Useful Links:

ITML Home Page

Category: Bonds> US Bonds> US Municipal Bonds

2.

FUND INFORMATION:

| Symbol: ITMS | Exchange: BATS |

| Name: VanEck Vectors AMT-Free 6-8 Year Intermediate Municipal Index ETF | Net Expense Ratio: 0.24% |

FUND OBJECTIVE:

The VanEck Vectors AMT-Free 6-8 Year Intermediate Municipal Index ETF seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Bloomberg Barclays AMT-Free 6-8 Year Intermediate Continuous Municipal Index.

The Fund is classified as a non-diversified fund and, therefore, may invest a greater percentage of its assets in a particular issuer. The Fund may concentrate its investments in a particular industry or group of industries to the extent that the Index concentrates in an industry or group of industries.

REFERENCE INDEX:

The Bloomberg Barclays AMT-Free 6-8 Year Intermediate Continuous Municipal Index is comprised of publicly traded municipal bonds that cover the U.S. dollar-denominated tax-exempt bond market with final maturities of 6-8 years.

As of June 30, 2016, the general obligations, transportation and special tax (i.e., revenue bonds backed by a specific tax) sectors each represented a significant portion of the Index.

As of June 30, 2016, approximately 15% of the Index consisted of municipal bonds issued by issuers located in California and approximately 16% of the Index consisted of municipal bonds issued by issuers located in New York.

Fund Top Holdings (09/21/16):

| State Of California | 6.30% |

| State Of California | 6.30% |

| County Of King Wa | 6.30% |

| Port Authority Of New York & New Jersey | 6.28% |

| State Of Minnesota | 6.21% |

| Miami-Dade County Expressway Authority | 6.19% |

| State Of Georgia | 6.16% |

| Pennsylvania Higher Educational Facilit | 6.07% |

| Salt River Project Agricultural Improve | 5.96% |

| New Jersey Economic Development Authori | 5.69% |

Useful Links:

ITMS Home Page

Category: Bonds> US Bonds> US Municipal Bonds

ETFtrack comment:

Here is a comment from James Colby, Portfolio Manager with VanEck:

“Historically, the intermediate portion of the curve has been a “sweet spot” in munis, having offered one of the greatest potential to gain incremental returns as investments move from longer maturities to shorter maturities, also known as rolling down the yield curve. ITM, and now ITML and ITMS, provide targeted ways for investors to potentially capture that opportunity in highly refined ways.”