BlackRock’s iShares begun trading the iShares International Aggregate Bond ETF (BATS: IAGG) on Thursday, November 12, 2015. Here is a synopsis of the new ETF:

FUND INFORMATION:

| Symbol: IAGG | Exchange: BATS |

| Name: iShares International Aggregate Bond ETF | Net Expense Ratio: 0.15% |

FUND OBJECTIVE:

The iShares International Aggregate Bond ETF seeks to track the investment results of the Barclays Global Aggregate ex USD 10% Issuer Capped (Hedged) Index.

REFERENCE INDEX:

The Barclays Global Aggregate ex USD 10% Issuer Capped (Hedged) Index measures the performance of the global investment-grade bond market.

As of October 30, 2015, there were 8,068 issues in the Underlying Index. The Underlying Index includes investment grade fixed-rate foreign sovereign and government debt, non-U.S. government-related, corporate, and securitized bonds from both developed and emerging market issuers.

Securities included in the Underlying Index are issued in currencies other than the U.S. dollar, must have maturities of at least 1 year and are required to meet minimum outstanding issue size criteria. The Underlying Index is market capitalization-weighted with a cap on each issuer of 10%. Debt that is publicly issued in the global and regional markets is included in the Underlying Index. Certain types of securities, such as USD-denominated bonds, contingent capital securities, inflation-linked bonds, floating-rate issues, fixed-rate perpetuals, retail bonds, structured notes, pass-through certificates, private placements, sinkable Russian OFZ bonds issued prior to 2009 and securities where reliable pricing is unavailable are excluded from the Underlying Index. The securities in the Underlying Index are updated on the last business day of each month, and the currency risk of the securities in the Underlying Index are hedged to the U.S. dollar on a monthly basis. Components of the Underlying Index primarily include fixed-rate foreign sovereign and government debt, non-U.S. government related bonds and corporate bonds. The components of the Underlying Index, and the degree to which these components represent certain industries, are likely to change over time.

As of October 30, 2015, the Underlying Index included securities issued by governments in 55 countries.

The Underlying Index sells forward the total value of the underlying non-U.S. dollar currencies at a 1-month forward rate to hedge against fluctuations in the relative value of the component currencies in relation to the U.S. dollar.

Top Constituents (11/11/15):

| JAPAN (GOVERNMENT OF) | 12.97% |

| ITALY (REPUBLIC OF) | 7.70% |

| FRANCE (REPUBLIC OF) | 7.36% |

| UNITED KINGDOM (GOVERNMENT OF) | 6.11% |

| GERMANY (FEDERAL REPUBLIC OF) | 6.03% |

| SPAIN (KINGDOM OF) | 4.07% |

| UK CONV GILT | 3.35% |

| KOREA (REPUBLIC OF) | 2.64% |

| BELGIUM (KINGDOM OF) | 1.97% |

| NETHERLANDS (KINGDOM OF) | 1.89% |

Top Country Breakdown (11/11/15):

| Japan | 12.97% |

| United Kingdom | 12.82% |

| France | 12.64% |

| Germany | 10.5% |

| Italy | 8.52% |

| Spain | 6.03% |

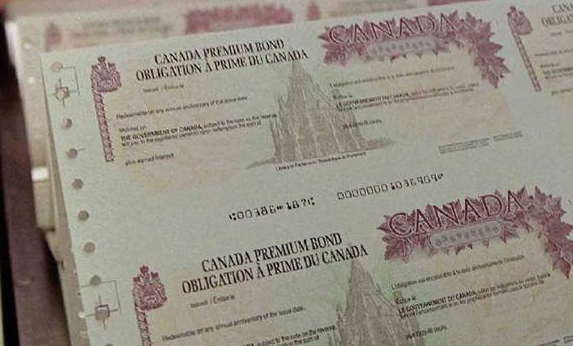

| Canada | 5.55% |

| Netherlands | 3.35% |

| Supranational | 3.18% |

| Australia | 2.89% |

Sector Breakdown (11/11/15):

| Treasury | 65.01% |

| Financial Institutions | 5.82% |

| Agency | 5.73% |

| Industrial | 5.66% |

| Covered | 5.45% |

| Local Authority | 4.19% |

| Supranational | 3.18% |

| Cash and/or Derivatives | 2.71% |

| Utility | 1.17% |

| Sovereign | 1.08% |

Useful Links:

IAGG Home Page

Category: Bonds> International Bonds>International Aggregate Bonds