First Trust, begun trading the First Trust Dorsey Wright Dynamic Focus 5 ETF (Nasdaq: FVC) on Friday, March 18, 2016. Here is a synopsis of the new ETF:

FUND INFORMATION:

| Symbol: FVC | Exchange: NASDAQ |

| Name: First Trust Dorsey Wright Dynamic Focus 5 ETF | Net Expense Ratio: 0.79% |

FUND OBJECTIVE:

The First Trust Dorsey Wright Dynamic Focus 5 ETF seeks investment results that correspond generally to the price and yield (before the Fund’s fees and expenses) of an index called the Dorsey Wright Dynamic Focus Five Index.

REFERENCE INDEX:

The Dorsey Wright Dynamic Focus Five Index is constructed pursuant to the Dorsey, Wright & Associates’ (Index Provider) proprietary methodology, which takes into account the performance of each of the First Trust sector and industry-based ETFs relative to one another. The Index is designed to provide targeted exposure to the 5 First Trust sector and industry-based ETFs that the Index determines offer the greatest potential to outperform the other First Trust sector and industry based ETFs and that satisfy certain trading volume and liquidity requirements. The Cash Index is also evaluated and its inclusion and weight in the Index is adjusted based upon its rank relative to the selection universe of sector and industry-based ETFs chosen by the Index. The Index Provider has retained Nasdaq, Inc., to calculate and maintain the Index.

Relative strength measures the price performance of a security versus a market average, another security or universe of securities. A security’s relative strength can improve if it rises more than the market in an uptrend, or goes down less than the market in a downtrend. The Index uses relative strength to evaluate the momentum of each First Trust sector and industry-based ETF to determine the five ETFs that have the highest level of momentum, which the Index determines have the greatest probability of outperforming the other First Trust sector and industry-based ETFs and that satisfy certain trading volume and liquidity requirements. The Index uses the price data of the selected First Trust sector and industry-based ETFs to perform the relative strength analysis. When determining relative strength, the Index takes into account a variety of factors to track movements and trends of securities prices over various time periods. The Index Provider has constructed the Index to identify longer term trends though a series of observations, which are used to determine the inputs for the relative strength analysis.

Security selection for the Index will be conducted in the following manner:

1. The selection universe of the Index begins with all of the First Trust ETFs and the Cash Index.

2. The Index then identifies the First Trust ETFs that are designed to target a specific sector or industry group, or that have a significant overweight towards a particular sector or industry group. The selected ETFs must also satisfy certain trading volume and liquidity requirements

3. The sector and industry-based First Trust ETFs are then ranked using a relative strength methodology that is based upon each ETF’s market performance. Relative strength is a momentum technique that relies on unbiased, unemotional and objective data, rather than biased forecasting and subjective research. Relative strength is a way of recording historic performance patterns, and the Index uses relative strength signals as a trend indicator for current momentum trends of a security versus another security.

4. The Index then selects the 5 top-ranking First Trust sector and industry-based ETFs according to the proprietary relative strength methodology for inclusion in the Index.

5. The Index is evaluated on a bimonthly basis and ETFs included in the Index are replaced when they fall sufficiently out of favor versus the other potential First Trust sector and industry-based ETFs on a relative strength basis. An ETF included in the Index will only be removed if it falls to the bottom half of the universe of First Trust sector and industry-based ETFs according to the Index’s relative strength methodology. A new ETF is only added to the Index when a current member is removed. The Index will always be comprised of five First Trust sector and industry-based ETFs. The relative strength analysis is conducted on weeks containing the second and fourth Friday of the month with the exception of the week between Christmas Day and New Year’s Day. When a sector or industry ETF addition or deletion is made, the portfolio is rebalanced so each position is equally weighted.

6. In instances where the relative strength begins to diminish among more than one-third of the potential First Trust sector and industry-based ETFs relative to the Cash Index, the Index allocates to the Cash Index. The target allocation to the Cash Index is equal to the percentile rank of the Cash Index within the Index’s relative strength rankings. The Cash Index may constitute between 0% and 95% of the Index; however, the maximum level that the Cash Index can be increased or decreased during an evaluation week is limited to 33% per evaluation. Changes in the Cash Index allocation within the Index will not cause the five First Trust sector and industry-based ETFs in the Index to be rebalanced back to equally weighted. For more information regarding the Index, please refer to the “Index Information” section of the prospectus.

Top Holdings (03/18/16):

| First Trust Consumer Discretionary AlphaDEX Fund | 12.56% |

| First Trust Dow Jones Internet Index Fund | 12.37% |

| First Trust Consumer Staples AlphaDEX Fund | 11.95% |

| First Trust Utilities AlphaDEX Fund | 11.88% |

| First Trust Health Care AlphaDEX Fund | 11.58% |

| U.S. Treasury Bill, 0%, due 04/14/2016 | 4.39% |

| U.S. Treasury Bill, 0%, due 04/21/2016 | 4.39% |

| U.S. Treasury Bill, 0%, due 04/28/2016 | 4.38% |

| U.S. Treasury Bill, 0%, due 05/05/2016 | 4.38% |

| U.S. Treasury Bill, 0%, due 05/12/2016 | 4.38% |

Useful Links:

FVC Home Page

Category: Equities> Regions> USA> US Sectors/Industries> US Sector Strategy

ETFtrack comment:

Here is a comment from Ryan Issakainen, Senior Vice President, Exchange-Traded Fund Strategist at First Trust:

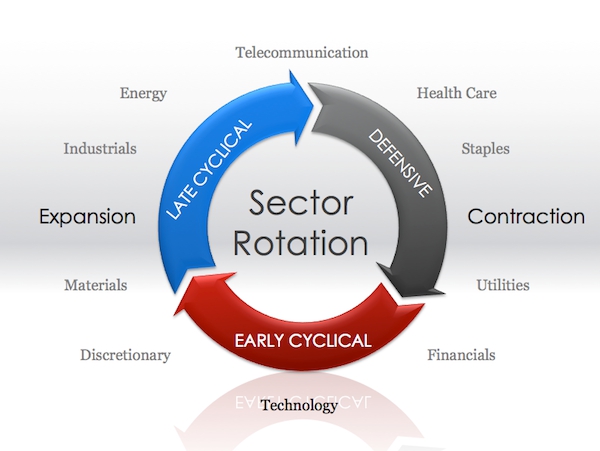

“The First Trust Dorsey Wright Dynamic Focus 5 ETF provides a simplified way for financial advisors and their clients to gain exposure to a sector rotation strategy with the ability to allocate to cash equivalents. Dorsey Wright’s research on relative strength is widely followed and we are pleased to offer this fund which tracks an index that combines their insights with First Trust’s lineup of sector and industry ETFs.”